This week, President Donald Trump, in a Truth Social post, strongly implied that 50-year mortgages would be coming during his presidency. Details on this move have not been provided, but the market is speculating on what this means for the housing market.

The introduction of 30-year mortgages were intended to make housing more affordable for individuals who cannot afford to pay off such a big loan in a short period of time. 50-year loans, also designed to make hosing more affordable, will do more harm than good. The negative impacts will be felt the hardest by the very people that these mortgages are supposed to help.

The key benefit of a longer mortgage is that it allows the principal (the amount being financed) to be paid down over a longer period of time. This means that the monthly mortgage amount would go down. As housing prices have become more unattainable due to rising costs, 30-year loans have become the standard for home buyers.

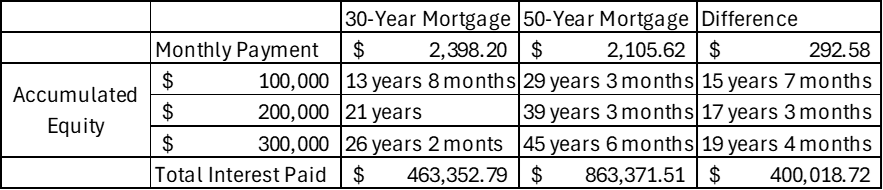

Mortgage loans are amortized; this means the payments at beginning of the loan are almost entirely interest. Most homeowners do not build significant equity in their homes until the tail-end of the mortgage. Extending the length of the loan will mean mortgage lenders will hold more ownership in your home for a longer amount of time. This makes 50-year mortgage homeowners far more susceptible to market shifts as they are not building wealth while paying their mortgage. Here are mortgage comparisons on a $400,000 house with a 6% interest rate:

This comparison shows that homeowners financing through a 50-year loan are going to pay significantly more interest. This comparison shows approximately $300 in savings on the monthly payment. However, paying an additional $400,000 in interest over the life of the mortgage is a lot. This alone makes a 50-year mortgage a less attractive offer. However, this also assumes that the interest rates will be the same for both loans.

As we see with current loans, the longer the term, the higher the interest rate. The Federal Reserve Bank of St. Louis (FRED) shows that on November 13th, 2025 mortgage rates were 6.24% for a 30-year loan and 5.49% for a 15-year loan. This difference of 0.75% is significant. This will hold true for even longer loans. 50-year borrowers will be paying higher interest rates than 30-year borrowers. This is because there is extra risk for mortgage lenders when financing a longer loan. Lenders are compensated for this risk by charging a higher interest rate.

If the rate difference between a 30-year mortgage and a 50-year mortgage is 0.5%, the new difference in the monthly payment on these two loans would be less than $150 per month! This means for an additional 20 years of mortgage and an additional $500,000 in interest, the home buyer is only saving $150 per month. It is not worth the cost.

Most mortgages are usually fixed rate. This means the interest rate you agree to at the beginning of the mortgage is the interest rate you will keep for the entirety of the mortgage. This may also change with 50-year loans. As mentioned before longer loans have more risk, and a way to mitigate some of that risk is to make the interest rate variable. This means that the interest rate will change. This makes it hard to predict what the monthly payment will be ahead of time.

A 50-year mortgage is a long time. It is highly probable that rates will increase several times throughout the life of the mortgage. Having these payments increase drastically will be a real burden on a lot of homeowners. If an individual is priced out of their current 50-year mortgage, they will be forced to sell the property or go into foreclosure. Selling the property will be problematic because their equity builds so slow on a 50-year mortgage. Paying the home for 10 years will not build enough equity cover the closing and selling costs if sold at that time. People will be forced into a cycle of having to constantly downgrade their living. Instead of a home building wealth, a 50-year mortgage will destroy it.

The real winners will be current homeowners who will see home prices rise as more people are eligible to be approved for these mortgages. Mortgage lenders will also win because they will be able to sell more mortgages under conditions that are far more favorable to the lenders than buyers.

The reason why people cannot buy homes is not because the loans are not long enough, it is because incomes have risen slowly and home prices have risen fast. 50-year loans are not the solution, and it will not make America better off. Please do not fall into the trap of taking out a longer loan for a house you cannot afford.

Leave a comment